Business Insurance in and around Independence

Get your Independence business covered, right here!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Whether you own a a hearing aid store, a pharmacy, or a HVAC company, State Farm has small business coverage that can help. That way, amid all the different decisions and options, you can focus on navigating the ups and downs of being a business owner.

Get your Independence business covered, right here!

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

When one is as committed to their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for worker’s compensation, surety and fidelity bonds, commercial auto, and more.

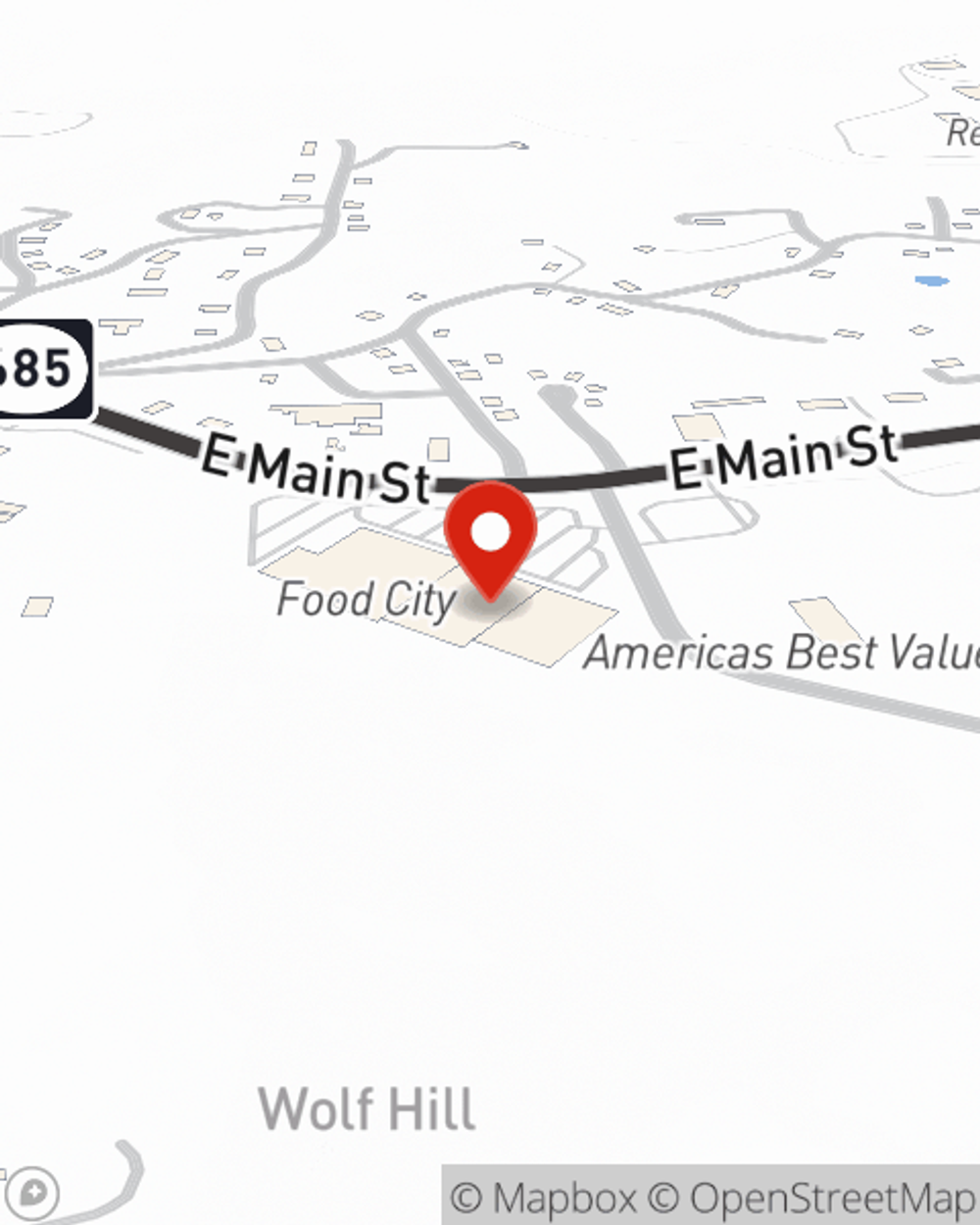

As a small business owner as well, agent Robby Wingate understands that there is a lot on your plate. Visit Robby Wingate today to review your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Robby Wingate

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.